Recent Investments for 2026

Good Morning,

I wanted to let you know that I made two investments into two existing positions in my retirement account. I discuss those briefly below.

Note, I am also in the process of selecting the companies for the lump sum investment for 2026. That would likely occur next week, as it takes a few business days for Robinhood to receive those funds and make them available for some reason. Please stay tuned for this update next week.

I also wanted to discuss my process on how I build a position and manage risk. Plus, I wanted to discuss Roth IRA accounts briefly, which are helpful in building tax-free wealth.

Building a Position and Risk Management

I invest in companies that meet my entry criteria.

Before I invest in a company, I decide how much money I am going to risk on that position. I also decide on the factors that would cause me to sell as well.

Other decisions involve monitoring the situation while I build the position. I tend to build my positions slowly, and over time.

Generally speaking, in order for me to invest in a company, it has to have a good valuation and good fundamentals. I would only try to invest in a company that I believe is a good quality one, that also sells at a good valuation.

When I build a position, I usually end up spreading this over a period of time. In some cases, this allows me to monitor how the company is doing relative to my original thesis. This allows me to limit capital allocated to a company that turns out to be a dud quickly.

For example, let’s assume that the target position size is $1,000 per company in a hypothetical portfolio. This is the most I would allocate to said stock.

If I were to build this position, that would mean putting something like $100 or so at a time, over a period of many months.

This exercise provides a few fundamental touch points to evaluate my thesis. Possibly a few quarterly reports, and a couple or so annual reports. Even more importantly one or two annual dividend increase announcements.

If I bought a security, and I saw that management all of a sudden stops raising the dividends at a typical rate of change, I would have red lights going in my head. I would investigate further. A slowdown in dividend growth is definitely a signal that something is going on in the business. This is possibly a good signal to pause new investments.

Losses of major customers, increased competition and stagnation in revenues and profits could also make me question my initial beliefs in the company, and pause investments.

I would continue monitoring the situation, and would consider investing again if fundamentals improve. Every company goes through a temporary lull in performance for various reasons. Only the solid ones tend to recover from those lulls (eventually). If they don’t, then chances are that the previously impregnable moat is pierced, or the industry is now facing some new headwinds. Think newspapers in the old days when the internet came, or sadly my beloved consumer staples as of recently.

If fundamentals go as planned however, I would be interested and build that position until I reach the maximum I could risk per security.

This fundamental exercise is of course going to be only performed if the valuation was attractive as well. However, value and growth are connected at the hip - meaning that valuation is part art, part science. It’s not as simple as stating that a stock with a P/E of 10 is cheap - you have to take into consideration the growth in fundamentals, and how cyclical that earnings stream is as well as the likelihood of a long runway as well. You need to look at the trends at a company level, to ensure you are not overpaying for slowing growth or overpaying for past success as well. Furthermore, you have an opportunity cost to pay, because there may be other securities that fight for your capital attention. You need to rank them, and decide (and that ranking could be further complicated by whether you already have a full position in said security or a partial or none at all).

The upside of course in building out a position slowly is that I stand a chance of allocating as little as possible in a security that surprises to the downside. Hence, protecting valuable capital that could’ve been deployed elsewhere.

The downside of building a position slowly is that many high class world quality companies tend to sell at a cheap valuation very rarely. Hence, buying slowly means that I could end up being too much underallocated to them. Knowing this information to me means that when I invest money every month, I should prioritize the “cheap” securities that are rarely in the attractively valued pile first, and only then should I focus on the companies that are more often attractive. Ironically, the companies that always look attractively valued are quite often the ones that turn out to be value traps.

Today, I presented my framework for building positions for my portfolio. This is the framework I had been using for the past couple of decades or so. You can watch it in action in my newsletter.

Roth IRA’s for Dividend Investors

Nothing is certain in this world except for death and taxes. For many dividend growth investors, this could be characterized as a feeling that they are being taxed to death. I am always on the lookout to legally minimize my investment taxes as much as possible. In fact there is an easy way to invest in dividend paying stocks without ever having to pay taxes on your investment.

The Roth IRA allows individuals who have earned income in a given year to contribute up to $7,500 in after-tax dollars to their retirement account for 2026. The contribution limit for 2025 was $7,000.. There is a catch-up contribution of $1,100 for individuals who are 50 years of age or older. While contributions to Roth IRA’s are not deductible on your tax returns, earnings and principal distributions are tax free once certain age and time requirements are met.

Roth IRA’s allow for tax-free compounding of capital over time. This means that you will not pay taxes on dividends or capital gains on your investments that are placed in a Roth IRA.

The earned income includes compensation from salary, wages, commissions, bonuses and alimony. Income from interest, dividends, annuities or pensions does not count as earned income in the eyes of the IRS.

A non-working spouse can set-up a Spousal Roth IRA, even if they have no working income, as long as the other spouse has enough working income to contribute. For example, if one of the spouses earns $50,000/year, and the other one stays home, they can each contribute $7,500/year to their own Roth IRA’s. If they are over the age of 50, the $1,100 catch-up contribution still applies.

The contribution limit for a Roth IRA is the same as the contribution limit for a regular IRA. However the amount that can be contributed to a Roth IRA is the amount remaining after subtracting any contribution made to a regular IRA. This means that if you contributed the maximum allowable amount to your regular IRA of $7,500, you would not be able to contribute anything to a Roth IRA in that year.

There are no required minimum distribution rules for Roth IRAs.

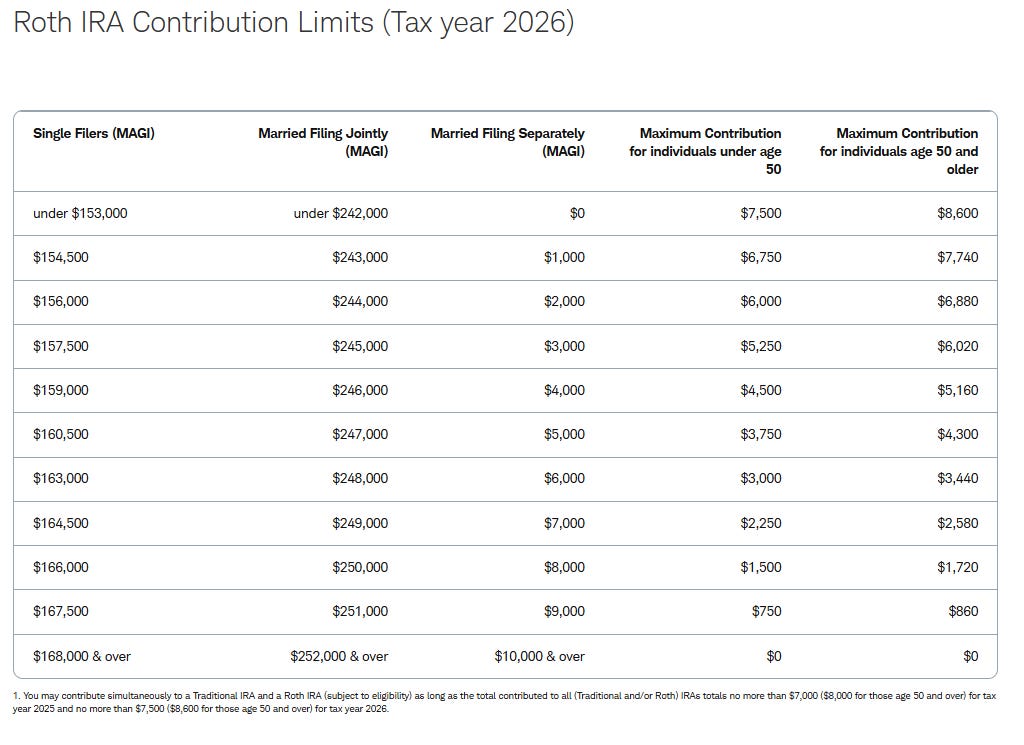

However, there are phase-out income limits for high earning taxpayers, which reduce the opportunity to use this tax advantaged investment account. A modified adjusted gross income (MAGI) of $252,000 for a couple filing jointly, or $168,000 for an individual makes you ineligible to contribute to a Roth IRA in 2026. The following table outlines the Roth IRA Contribution limits for 2026.

Source: Schwab

There are ways around it of course, using the “Backdoor IRA Conversion” Strategy. Basically, it entails contributing to a Regular IRA, and immediately converting it to a Roth.

In order to avoid paying taxes on distributions from Roth IRA accounts, investors need to become acquainted with the qualified nontaxable distribution rules.

According to the IRS, qualified nontaxable distributions for Roth IRA’s are those made at least 5 years after the taxpayer’s first contribution to a Roth IRA and made:

1) After the taxpayer become 59.5 years old

2) To a beneficiary after the death of the taxpayer

3) Because the taxpayer becomes disabled

4) For a use of a first time homebuyer

The biggest benefits of a Roth IRA are the long-term tax free compounding of capital, the fact that qualified distributions are tax-free and the fact that there are no required minimum distributions.

Another little known fact behind Roth IRA’s is that direct contributions may be withdrawn at any time.

This makes them a perfect investment vehicle for investors who plan on retiring early and living off dividends before they reach typical retirement ages of 60 years.

I hold a portion of my assets in a Roth IRA. While the contribution limit is only $7,500, that is still a good start. For a married couple maxing out their Roth IRA’s, you have $15,000 to invest.

In today’s commission free world and fractional shares, you can build a diversified portfolio fairly easily.

First Investments for 2026

Keep reading with a 7-day free trial

Subscribe to Dividend Growth Investor Newsletter to keep reading this post and get 7 days of free access to the full post archives.