Recent Investment for March 10, 2025

Good Morning,

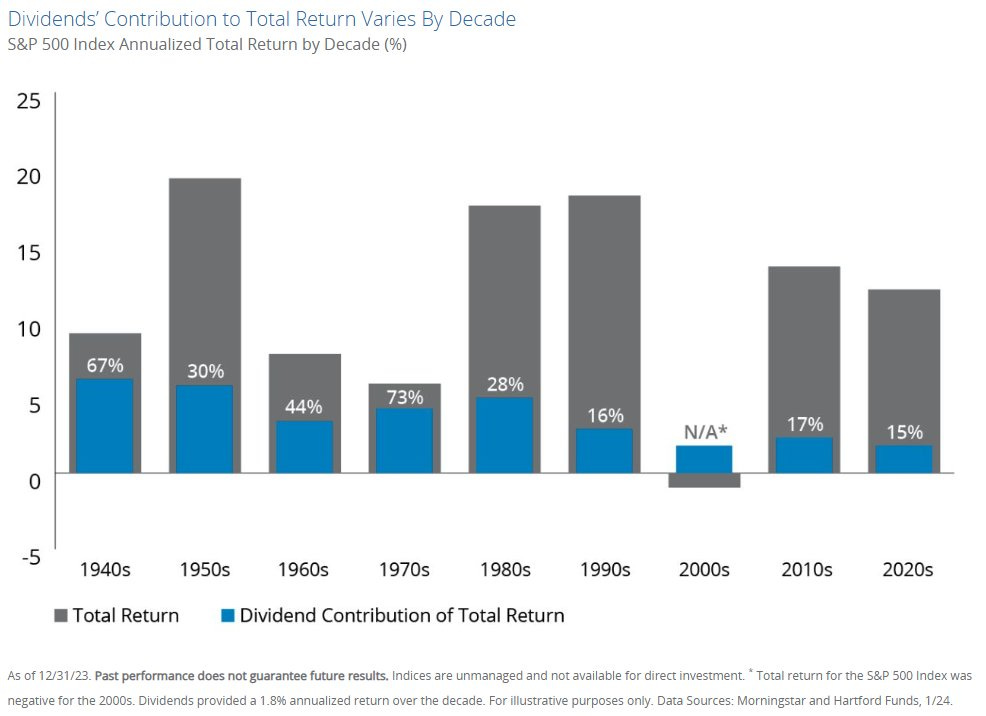

As you know, we are in the middle of a stock market correction. Naturally, that is exciting news for those who are in the accumulating phase. After all, lower prices means that future dividend income is available on sale.

For those in the retirement phase, that correction is just noise. One can simply live off their dividend income, and ignore the noise.

During a market correction, the benefit of following a diversified dividend growth investment strategy is obvious. Your stocks decline by less, you are paid to hold a rising stream of cash dividends, and it is simply easier to stay the course and stay invested.

I can always count on the dividends and rely on them. Share prices can go up or down, but I never know if they will be up when I need them to. I know I can count on the dividend stream however.

Dividends are always positive, they are easier to forecast and rely on. When things are tough, I can rely on the dividends to keep me invested. When everyone is focused on the prices, I am paid to hold and I can be patient

Unfortunately, despite this correction, a lot of companies on my wish list (new or existing holdings to add to) are still not selling at cheap enough prices. For example, ADP is still selling at over 30 times forward earnings.

Anyways, I shared my research of the Dividend Aristocrats list I did last night. I identified 26 companies for further research.

I added to an existing holding this morning after doing some research.

I basically ran through the list, and looked at the companies, by valuation. I then looked at the companies that seem fairly valued, and decided to add to the one that I have the lowest exposure to.

Keep reading with a 7-day free trial

Subscribe to Dividend Growth Investor Newsletter to keep reading this post and get 7 days of free access to the full post archives.