How much money do I need to retire on dividends?

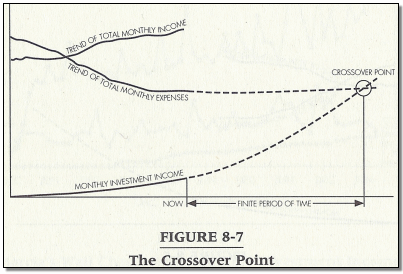

I follow a simple guideline on how much I need to invest and how long it would take to reach the dividend crossover point.

This is the point at which dividends exceed expenses.

Getting to the Dividend Crossover Point is a function of:

1. How much is invested every month

2. Rate of return (Dividend Yield + Dividend Growth)

3. How long you invest for

The general overview in the model described today is foundational knowledge that I have tried to instill with the Dividend Growth Investor Newsletter from its very beginning.

Ultimately, getting to the coveted crossover point is a function of the trade-offs on the three items listed above.

For example, if you need to generate $30,000/year in dividend income in retirement tomorrow, you’d need something like $1 Million in cash to invest today. Nobody just hands you $1 Million in cash of course. And to add insult to injury, you may need more than $30,000/year as well. (But you can still use this thought process for different unique scenarios, as it is scalable - e.g. if you need $60,000, just double the numbers from above. I know, easy peesy).

However, if you need that $30,000/year in dividend income in 22 years, you need to invest about $15,000/year starting today

Lesson: It pays to plan ahead, and have SMART goals.

Keep reading with a 7-day free trial

Subscribe to Dividend Growth Investor Newsletter to keep reading this post and get 7 days of free access to the full post archives.