Dividend Growth Investor - Recent Investment for January 5, 2026

Good Morning,

I wanted to let you know that I made three investments this morning in existing holdings. I made those in my taxable account, as I had some spare cash there. I also wanted to provide update on the Roth IRA lump sum investment, alongside some notes about my strategy and what I look for in dividend companies.

Process Description Update

As part of my review process, I identified a few patterns that just stood at me. Notably, that my biggest mistakes have been selling too early or not investing in a security.

Another factor I have noticed is that some of the companies I invested in that worked tended to have the data characteristics that looked promising on first view. In other words, the trending in earnings, dividends, payout ratios looked promising on a fundamentals perspective. Waiting for the right valuation was the next important point.

For many of the companies that did not work out however, a common denominator was that the data was inconclusive. However, I spent time trying to convince myself qualitatively, resulting in a very long essay on future growth vectors, etc.

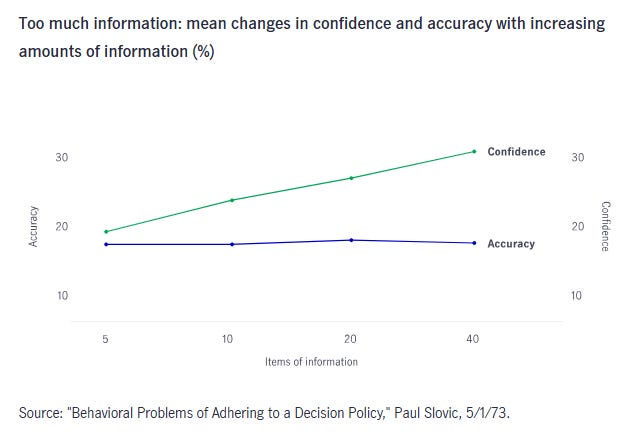

Ultimately, this leads me to believe that I should simply make my analyses shorter, and more to the point of being more quantitative versus qualitative. This change can help reduce some of those behavioral errors I identified above. This observation goes hand in hand with research I’ve read, which states that higher amount of information past a certain point does increase your confidence in a decision. However, this doesn’t actually improve quality of that decision, nor does it make it better or more accurate. In other words, one should still do the work to form their opinion. However, past a certain point, there is a point of diminishing returns.

This is not really a change, as these have been deciding factors for a while. It just means there would be less fluff, that sounds smart, but doesn’t actually add value. It means there will be focus on how the business is doing, rather than falling for a narrative. The important factors behind growth in dividends per share are the rise in earnings per share over time. If we get stagnation in earnings per share over a time period, then that means something is going on, so we need to take a pause. If dividends per share growth slows down all of a sudden, this is also a cause to take a pause. While valuation is important, as we do not want to overpay, we also do not want to miss out on the potential for dividends if we wait for a small decrease in the valuation ratios that never arrives.

This basically goes back to focusing on things that work. Namely, starting with a known population of dividend growth companies, and then narrowing it down through my initial screening criteria.

Next, evaluating each company individually, to identify the most promising candidates and acquiring them at a certain valuation range.

Next, that means managing risk, by refusing to “bet” more than sound diversification tells us to do. It also means looking for refuting evidence as we establish the position.

It also means that once a position is established, we sit on it, until the exit criteria are met. This means not micromanaging management. I have evaluated my investments, and determined that selling was a big mistake. Hence I try to “never sell”. I do sell after a dividend cut and after a company is acquired. If one nitpicks, they can find exceptions to anything of course. On the aggregate however, nitpickers lose. The “never sell” does work wonders on aggregate. Experience does confirm it. So far at least.

The truth is, nobody can determine in advance which position will be the best one, and which one would turn out to be the worst one. There will be a small percentage of companies that really do well. There will be a percentage of companies that don’t do well. The trick is to hold on to the winning companies for as long as possible, because they would compensate us for the ones that don’t do as well. And they will be the deciding force between making a profit or not.

This type of humility is important in my opinion. Accepting I could be wrong from the start helps me make the decisions based on data, rather than “feelings” and influences and assumptions. Being humble makes me open to ideas, knowing the future could be different than my expectations, but still arranging affairs in a way that a single bad bet won’t bankrupt me. The goal is to stay in the game long enough for the power of compounding to kick in.

Note, all of this would make sense if you have seen my work in how I evaluate companies, and read my stock review reports.

Roth IRA Lump Sum

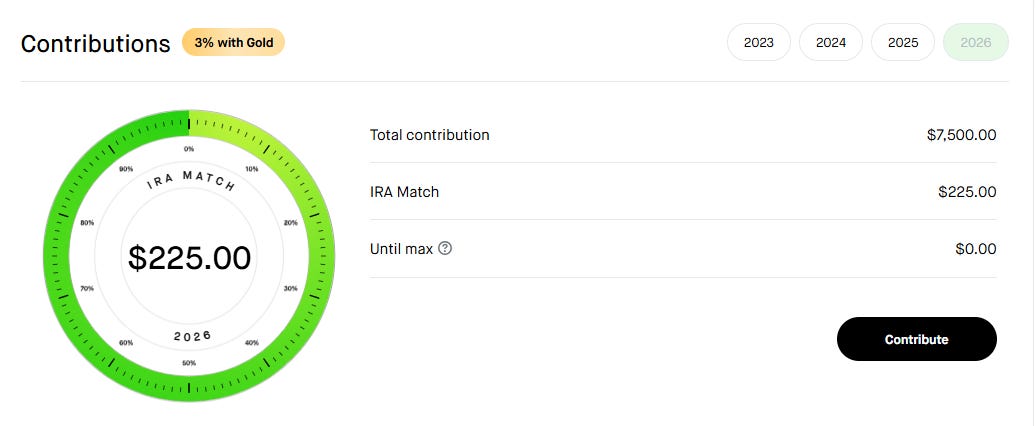

I have contributed the full $7,500 to my Robinhood Roth IRA, which notified me that money takes 1 - 5 business days to be available for investment. I would assume it would be fully available some time this week. The money is available right away with other brokers, but with Robinhood you get a 3% match on those contributions. I have the list of companies available, just need to have the funds available for investment to deploy.

Anywho, I will be adding to three companies in my taxable account today. These are all existing positions, which have shown:

Growth in earnings per share

Growth in dividends per share

Adequate Dividend Coverage

Attractive Valuation

All of those have been beaten down recently

Investments for January 5, 2026

Keep reading with a 7-day free trial

Subscribe to Dividend Growth Investor Newsletter to keep reading this post and get 7 days of free access to the full post archives.