Dividend Growth Investment for November 12th

Good Morning,

With stocks at all time highs, valuations on many companies are rich today. With interest rates on the decline as well, valuations are getting another jolt up. I find it harder to find good quality companies available at a good valuation.

Right now, the dividend yield on S&P 500 index, the barometer of how the US stock market is doing, is at the lowest point in the past decade. It's also one of the lowest points of record. While I am not a market timer, previous levels in the dividend yields associates with the one today have marked highs in the US market.

Earnings have been on a tear however, and expected to grow further:

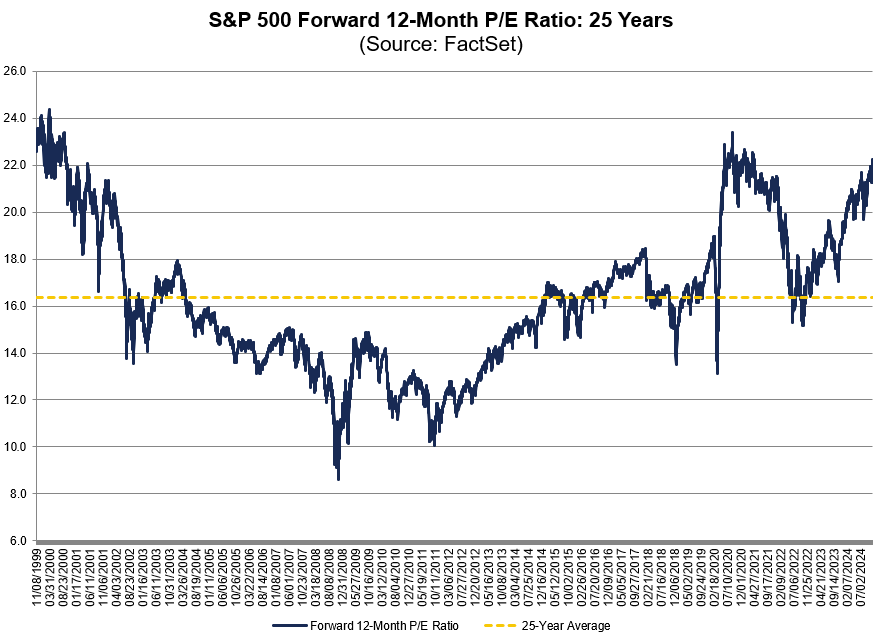

Valuations have been high however:

However, long-term returns on stocks are a function of:

1. Dividends

2. Earnings per share growth

3. Change in valuation

In the long-run, the thing that really matters is growth in earnings per share and the power of dividends. Changes in valuation matter the least. That long-run is at least 10 - 20 years.

In the short-run however, the thing really impacts results is valuation. For example, if you acquire a good company at 15 times earnings versus 25 times earnings, your returns would be better in the former. It makes intuitive sense, because a lower P/E company would likely have a higher starting dividend yield as well. With a higher starting multiple, you lock in a lower current yield, and you may also be overpaying for the immediate growth in fundamentals, leaving you with less margin of safety. If you pay 25 times earnings for a business that is then re-rated to 15 times earnings, you are facing a headwind in total returns.

You may like this chart, which summarizes the sources of expected returns by component (dividends/earnings growth/P/E change) from 1900 - 2019

However, I view the stock market as a market for stocks. There are often good companies that are selling at premium valuations. However, there are often good companies that are selling at attractive valuations as well. It is the goal of the investor to turn over a lot of rocks, and identify a good company for investment. It is important however to avoid companies if a company is cheap because fundamentals are deteriorating. I keep reviewing my investable universe of dividend achievers. I also keep reviewing existing portfolio holdings. I keep screening, following dividend news and trying to uncover companies for research.

I wanted to let you know that I initiated a new position today. The company I invested in is a dividend achiever with a 28 year track record of annual dividend increases under its belt. It has a 5 year annualized dividend growth rate of 9.80%. The stock sells for 21 times forward earnings and yields 2.20%. It operates under a duopoly/oligopoly (based on how you look at it).

This is a Canadian based company, which has operations in Canada and US. I am buying it in my retirement account, which means that I will not be assessed the witholding tax on Canadian dividends at source.

I view this stock as a long-term bet on the economic growth of North America.

Keep reading with a 7-day free trial

Subscribe to Dividend Growth Investor Newsletter to keep reading this post and get 7 days of free access to the full post archives.