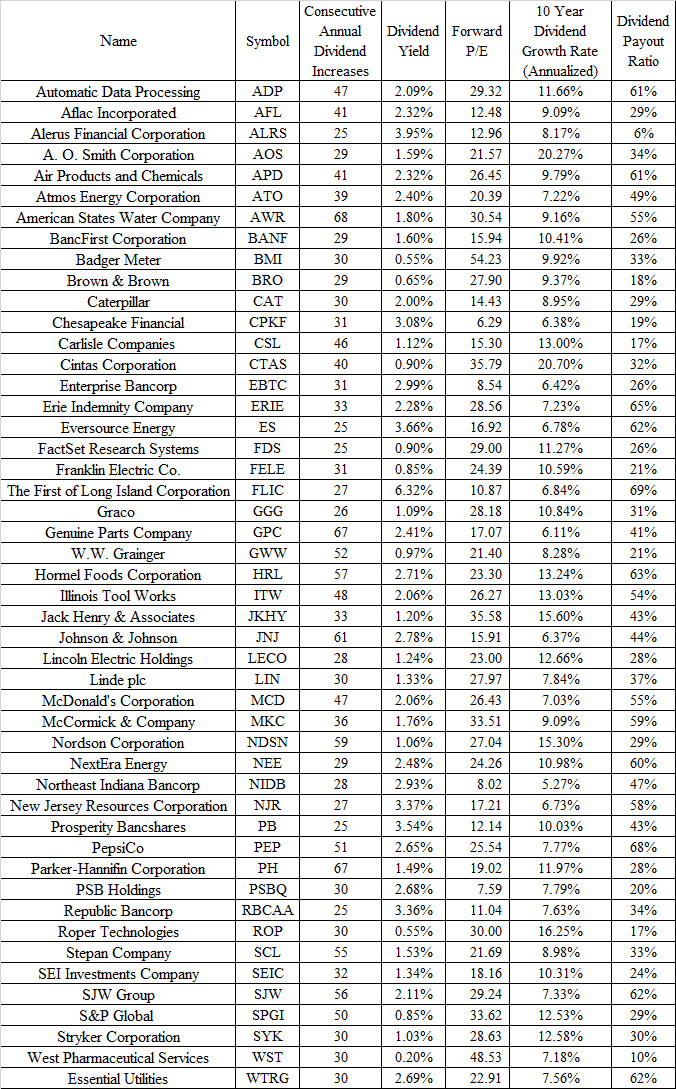

48 Dividend Champions For Further Research

As part of my research, I ran a screen on the Divided Growth Investor Universe.

I looked for companies, which have:

1) Increased dividends for at least 25 years in a row

2) Consistently managed to increase dividends by at least 5%/year over the past decade

3) Increased earnings per share over the past decade

4) Forward Dividend Payout Ratio below 70%

I came up with a list of 48 Dividend Champions for further research here:

In my opinion, these are great companies for further research. I believe they posses the characteristics to keep growing dividends over the next decade. I also view them as quality companies as well.

However, I believe that investors need to evaluate each company, in order to confirm they are well suited for their portfolios.

In addition, investors need to determine if the valuation is right. Quite often, the best quality companies command a premium. Choosing between companies can only be done if you understand the business, the defensibility of the earnings stream, the growth pattern and combine that with today's valuations metrics such as P/E.

I am mainly posting this list as a starting point for my research, nothing more. I would be monitoring the list, and potentially pouncing on the right opportunity if they appear attractively valued.

Thank you for reading!

Dividend Growth Investor

https://www.dividendgrowthinvestor.org

Disclaimer: This portfolio is for educational purposes only. By reading this newsletter you are agreeing that you are solely responsible for your investing decisions. Stock investing is risky and can lead to losses in capital. Past performance is not indicative of future results.